Thousands of Americans face emergencies in the most unexpected moments. Frankly speaking, you cannot always be prepared for all difficulties, and finances aren’t an exception.

But most of these difficulties can be avoided if people are more financially educated.

Our life consists of education. When you go to school, you take the knowledge that will help you to choose your future university direction and job in perspective. But only some schools teach you to manage finances properly.

In school, we needed to learn where to get a small loan when we needed urgent money or how to invest part of our salary, not to save money under the pillow.

Money management is essential and will allow you to handle income wisely.

Don’t understand where you spend such amounts of money? Are you of the opinion that you earn enough, but this ‘enough’ isn’t sufficient?

Financial literacy is an excellent way not to put yourself in a pit of money and to prevent difficulties.

The financial world is full of ups and downs.

You can think that you know everything in this sphere. There are many tricky moments you never thought about. So, it’s time to dive into this ocean!

Age vs. Education

I want to pick your brain: “Do you support the statement that your age can hamper learning something new?” No matter what your age, it is never too late or vice versa, too early if you want to be financially literate.

Parents can teach you to understand the value of money from your very first steps. For example, while shopping, they can explain that the price of $30 is high for purchasing and to pay attention to the same product, but with a lower cost.

In this case, your mind will understand that more or fewer can frequently replace expensive things.

Mum or dad can turn this exercise into an exciting game. One of the family members can show a baby product you can’t afford and ask the child to find something identical but cheaper. Afterward, together calculate what sum price of the first is higher than the second.

Indeed, getting older, your financial goals change. From dreaming about a doll house, you consider buying your own home.

Having reached an even older age, you desire to stop giving up work and live your peaceful life in the desirable retirement.

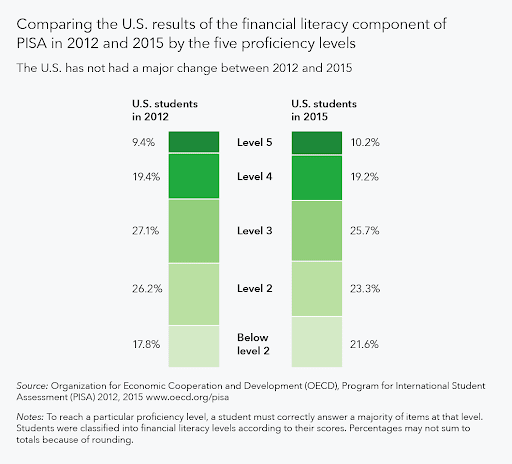

The following table shows how U.S. adolescents understood financial concepts and could apply them to their situation in 2012 and 2015.

How Important Financial Literacy Is

Financial literacy is a simple but effective instrument with the help of which you can improve your financial literacy!

- The more financially literate you are = the more money you have in your piggy bank.

- The more educated you become financially = the safety of your money in life increases significantly.

Financial literacy is critical to making well-thought-out and mindful decisions. What is more, when your retirement comes, you will have enough to live on.

You have already understood that literacy is essential for any area. The financial world requires an even more knowledgeable manner. So, are you interested in improving your financial literacy?

Understand Yourself & Your Situation

Do you want to improve your financial situation? Then look at it not as someone who wants to change but as a specialist who needs to describe an accurate picture.

1. What does your spending look like?

You must be familiar with expenditure habits. It’s not a secret. Many of us don’t realize that spending is not as essential as it looks at first glance.

Therefore, if we stare at our list of “needs,” we will catch – something that can be set aside.

To get rid of bad habits, cultivate one good!

Save your checks or use your banking apps to have a coherent picture of your purchases.

Firstly, find out the most unnecessary things. You are more likely to spend money on something unhealthy.

Is your well-being worth this? You pay $30 to buy harmful food, but have you ever thought about the consequences?

This kind of dish hurts your health, then the hospital. As you know, medicine is expensive enough. This way, your $30 can turn into $300 or more.

2. What is your credit score?

Many things in life require a good credit rating:

- To apply for a loan,

- To buy a large purchase,

- To rent a place to live.

Do you have the desire to know where to improve your economic figure? Understanding what credit score you have will help you with this.

Good to know: Multiple credit bureaus or your local bank will let you check your score free of charge!

However, don’t stand up from the couch and go to the bank. You must ensure your bank offers such an opportunity without paying for it!

Start Budgeting

Budgeting is a must if you don’t want your money last!

You can reach lots of funding goals with budgeting.

Income + Charges = Budget

Knowing expenses and your income assist you with creating a budget.

These actions will help you to understand your budget by the week:

- Take your expenses out of your income.

- With your remaining amount, deduct a portion to save.

- Split the amount of money you have after deducting your expenses into 4.

Box for Emergency

When an emergency happens, each person gets lost because of misunderstanding what solution will be more appropriate.

People ask themselves: “Why don’t I have any money for emergencies?” Really, why don’t you have them? Just set aside some percentage of your income in a special box, name it “For unforeseen situations,” that’s all.

Simple process, don’t you think so? The most challenging thing is to remember that you must put money in a box monthly!

Time to Catch a Thief

Nowadays, we have many online thieves in our country. Everyone wants to earn money. Unfortunately, some work hard and receive money, while others rob them.

Those who want to get money without standing in bed can even make their own “online bank” to provide people with financial “help,” so it’s essential to know how to identify this type of robbery!

Here are two vital pieces of advice to prevent facing with work of thieves:

- Be wise when it comes to giving personal information such as your bank account number or social security number. Don’t know if you are dealing with a trusted service? Say: “Goodbye!”

- Pay close attention to what you click on online.

You’re getting closer to being financially literate. You have an excellent opportunity to change your current and future life from this minute! Don’t lose this chance!